Cost of doing business in Scotland

Scotland is a competitive location to do business compared with other European cities such as London, Dublin and Berlin. You'll benefit from lower business rates, cost of living and employee overheads. This all means extra capital to grow your business.

Last updated: July 2024

Your capital goes further

Scotland is a great place to locate your business – and reports show it’s less expensive to live and work in Scotland than cities like London, Zurich, Paris and Dublin.

Your investment in people will go further in Scotland, because the cost of living is lower here than in many other parts of the UK.

You’ll also be pleasantly surprised by how attractive your talent costs will be.

Lower costs for higher return on investment

Here are some of the reasons why Scotland is a world-leading business location.

-

Costs up to 48% less than London

*Scotland is an extremely cost-effective location for property, staff and cost of living compared to London.

-

Low-risk location

Scotland is a stable, safe and secure location with strong, transparent government and robust legal institutions with coherent regulatory practices.

*Source: Marsh Finance (March 2024)

Property and sites to suit your business

Scotland offers a diverse range of property solutions that will help your business thrive.

You’ll benefit from city centre locations and business parks within an easy commute of 2.8 million people. There are also rural sites, industrial units, large-scale manufacturing plants, port-side facilities and development land for new build options.

Whatever your business needs, we can help you find the right location.

Benchmarking your business costs

When estimating operating costs for a new facility, several factors will affect your benchmark. These include the type and size of facility you're looking to set up, the number of people you'll employ, and the functions that the site will perform.

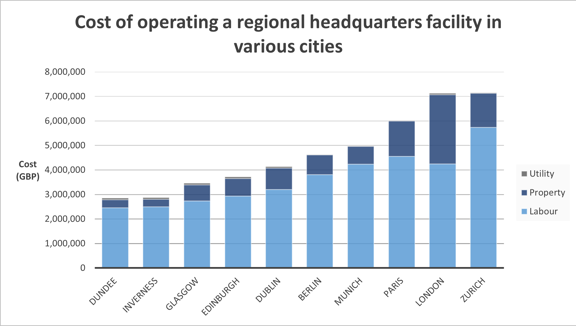

The following chart shows the average annual cost of running a 50-person regional headquarters facility in four Scottish cities (Dundee, Inverness, Glasgow and Edinburgh) and in six other European business locations.

This site would typically house senior management personnel, finance, HR, sales and other crucial parts of the business.

Source: Financial Times fDi Benchmark (October 2022)

This comparison highlights some important facts:

- Costs are at least 20% lower in Scotland than in the other locations (comparing Edinburgh and Berlin) and as much as 60% lower (comparing Dundee and Zurich).

- Costs in all four Scottish cities are lower than in Dublin and Berlin, which both offer lower-than-average facility costs.

- Comparing UK capital cities, it's 48% cheaper on average to run a headquarters facility in Edinburgh than in London.

If you need more information and support for costing your specific project, our expert advisers can help you benchmark costs in your desired locations.

Funding and incentives

If you locate your business in Scotland, you'll be able to take advantage of a wide range of funding and incentives. This will help you put your business on a solid footing from the beginning.

This support can include grants, tax relief, venture funding and lots more. Through these interventions, you'll be able to make your business more productive, efficient and sustainable, allowing you to support activities like research and development, greening your business, or training support.

A place that's home

We understand that you need to consider more than just the cost of living before deciding to set up business or operations in a new country. If you do choose to set up in Scotland, you'll also benefit from its welcoming business environment, diverse industries, vibrant cities and stunning landscapes. It's a place that you can call home.

These are just some of the reasons why international companies love Scotland – and why the country has enjoyed a strong flow of inward investment over the last ten years.

Watch our video to learn more about what Scotland can offer you.

Enjoy a fantastic quality of life

By investing in Scotland, you’ll still have the connections with our partners and networks and easy access to world markets you need to grow your business. And, with convenient commute times between our major cities, Scotland gives you the opportunity to find the work-life balance that suits you.

Got questions about healthcare, housing, education or culture in Scotland? Scotland.org can help answer your questions.

Learn more about living in Scotland on Scotland.orgopens in a new window

You might have heard of our stunning scenery, vibrant cities and world-famous golf courses – our low cost of living means you can enjoy them all.

Learn more about locations to live and work on Scotland.orgopens in a new window

You might also be interested in

-

Investment opportunities

Scotland is one of Europe's top investment locations with its smart cities, enterprising business parks and prime real estate, all open to you.

-

Financial and tax incentives

We can provide the financial support you need to make your project come alive.

-

Companies we've helped

Learn about companies we've supported that are thriving in Scotland.

Join our mailing list

Get trade and investment updates, news and insight from Scotland direct to your inbox.

Ask our experts

Got a question about cost of doing business in Scotland? We’re always ready to help.